What is proof of funds and why do estate agents ask for it?

Proof of funds, or POF, includes financial documents that show a property buyer has money readily available to complete a purchase. Estate agents ask for these documents to confirm the buyer’s financial position, meet anti money laundering regulations, and reduce the risk of fraud during the sale process. This early financial verification ensures smoother property transactions and helps assess buyer credibility from the outset.

What We Have Covered In This Article?

- Why proof of funds matters when buying property

- What is proof of funds?

- Why do estate agents ask for proof of funds?

- When is proof of funds required?

- How to provide proof of funds: a step by step guide for homebuyers

- What if there are complications with your proof of funds?

- How does proof of funds relate to mortgage applications?

- Avoid these common mistakes when providing proof of funds

- How sellers react to prompt versus delayed proof of funds

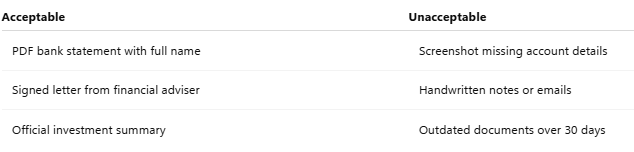

- Accepted versus rejected proof of funds examples

- Common buyer questions answered

Why proof of funds matters when buying property

Estate agents must ensure that buyers are financially prepared before moving forward. Verifying proof of funds supports estate agent proof requirements and gives sellers confidence that offers are backed by real purchasing power.

First time property buyers may not be familiar with this step, but it’s an essential part of buying a home. It helps build trust, protects against financial fraud, and maintains transparency in the property transaction timeline.

What is proof of funds?

Buyers need to provide documents that clearly show they have enough money to buy the property. These might include:

A bank statement with the account holder’s name and balance

A formal letter from the bank confirming funds

Statements from investments or savings accounts

A signed letter from a financial adviser confirming the availability of funds

Estate agents focus on liquid assets, meaning money that is accessible. The documents must be official, up to date, and issued by a recognised financial institution. Redacting too much can lead to confusion or delays.

Pro Tip: Always use statements dated within the last 30 days to avoid instant rejection.

Ehab Barrain

Managing Director at Barrain Estate Agents London

Struggling with Kerb Appeal? Let Barrain Help You Shine

Our professional agents will provide a tailored kerb appeal review and actionable tips to boost your home’s attractiveness.

Why do estate agents ask for proof of funds?

UK estate agents are required by law to follow anti money laundering regulations. As part of these requirements, they must confirm the source and accessibility of a buyer’s funds.

Providing proof of funds also boosts buyer credibility. In highly competitive markets, a buyer who can show proper documentation early on will stand out. While buyers may redact personal details such as account numbers, the name, balance, and statement date must remain visible.

When is proof of funds required?

Proof of funds may be requested at several points in the property transaction timeline:

Before viewing a property

When making an offer

After an offer is accepted but before contracts are signed

Delaying proof of funds can harm your chances. Sharing these documents promptly shows financial transparency and helps move the transaction forward.

How to provide proof of funds: a step by step guide for homebuyers

What documents count as proof of funds?

Use recent bank statements, investment account summaries, or a letter from your bank or adviser.

How do I make sure documents are suitable?

They should be current, clearly show your name, and include the available balance.

Can I hide sensitive information?

Yes, but only remove account numbers or unrelated details. Leave the name, date, and balance visible.

How should I submit the documents?

Hand them over in person or send them by secure email to your estate agent.

What if more information is needed?

Be ready to provide extra details quickly if your agent requests them.

If you are unsure, your adviser can help you gather the right documents.

Ready to Sell? Get Your Home Ready with Barrain Estate Agents

Let Barrain guide you in showcasing your home’s best kerb appeal and get the best offers in your market.

What if there are complications with your proof of funds?

Sometimes buyers hold money in a joint account or have funds in another country. In these cases, you might need a letter from the joint account holder or documents proving that international funds can be transferred. Being honest and providing the right paperwork will help avoid problems.

How does proof of funds relate to mortgage applications?

Even if you have agreed a mortgage in principle, estate agents will still ask for proof that you have money available for your deposit. Mortgage approval and proof of funds are two separate checks and both are essential to complete a property purchase.

Avoid these common mistakes when providing proof of funds

Submitting outdated documents

Always use documents from the last 30 days so they reflect your current finances.

Redacting essential details

Leave your name, balance, and date visible. If any are missing, the agent may ask for new documents.

Ignoring the request

Not providing proof when asked could result in your offer being overlooked.

Using unverified sources

Use only documents from regulated financial institutions or certified professionals.

Pro Tip: Include a cover letter if your funds are spread across multiple accounts.

Ehab Barrain

Managing Director at Barrain Estate Agents London

Want to Maximise Your Home’s Value?

Barrain Estate Agents know exactly what buyers look for — starting with the perfect first impression. Contact us for expert advice.

How sellers react to prompt versus delayed proof of funds

Sellers are more confident with buyers who provide proof of funds quickly. It shows that the buyer is serious and ready to move forward. If you delay or send unclear paperwork, the seller might reject your offer.

Expert insight

Claire Adams, a UK conveyancing consultant, advises: “Most estate agents expect proof of funds within 48 hours of an accepted offer. Prompt submission can keep negotiations on track.”

Accepted versus rejected proof of funds examples

Common buyer questions answered

Can I use a gifted deposit as proof of funds?

Yes, but include a letter from the person gifting the money. It should confirm the gift is not a loan. This supports financial transparency and shows you are contract ready.

What if my funds are split across several accounts?

That is fine. Provide statements for each account and make sure the combined total covers the cost. Agents may still need a single summary to verify the total amount.

Do I still need proof of funds if I have a mortgage in place?

Yes. Estate agents need separate confirmation of your deposit funds. Mortgage agreements only cover part of the property value.

How private is this information?

Estate agents handle it securely and are required to protect your personal data under data protection laws. Your documents are used solely for financial verification.

Final thoughts on proof of funds for your property purchase

Having your documents ready gives you a better chance of having your offer accepted. It shows that you are serious and capable of completing the sale.

Whether this is your first home or not, providing clear proof of funds helps avoid delays and keeps the process moving. If you are unsure, speak with your estate agent or adviser. They are there to help.